What is SIP in Mutual Funds? Complete Guide for Beginners in India

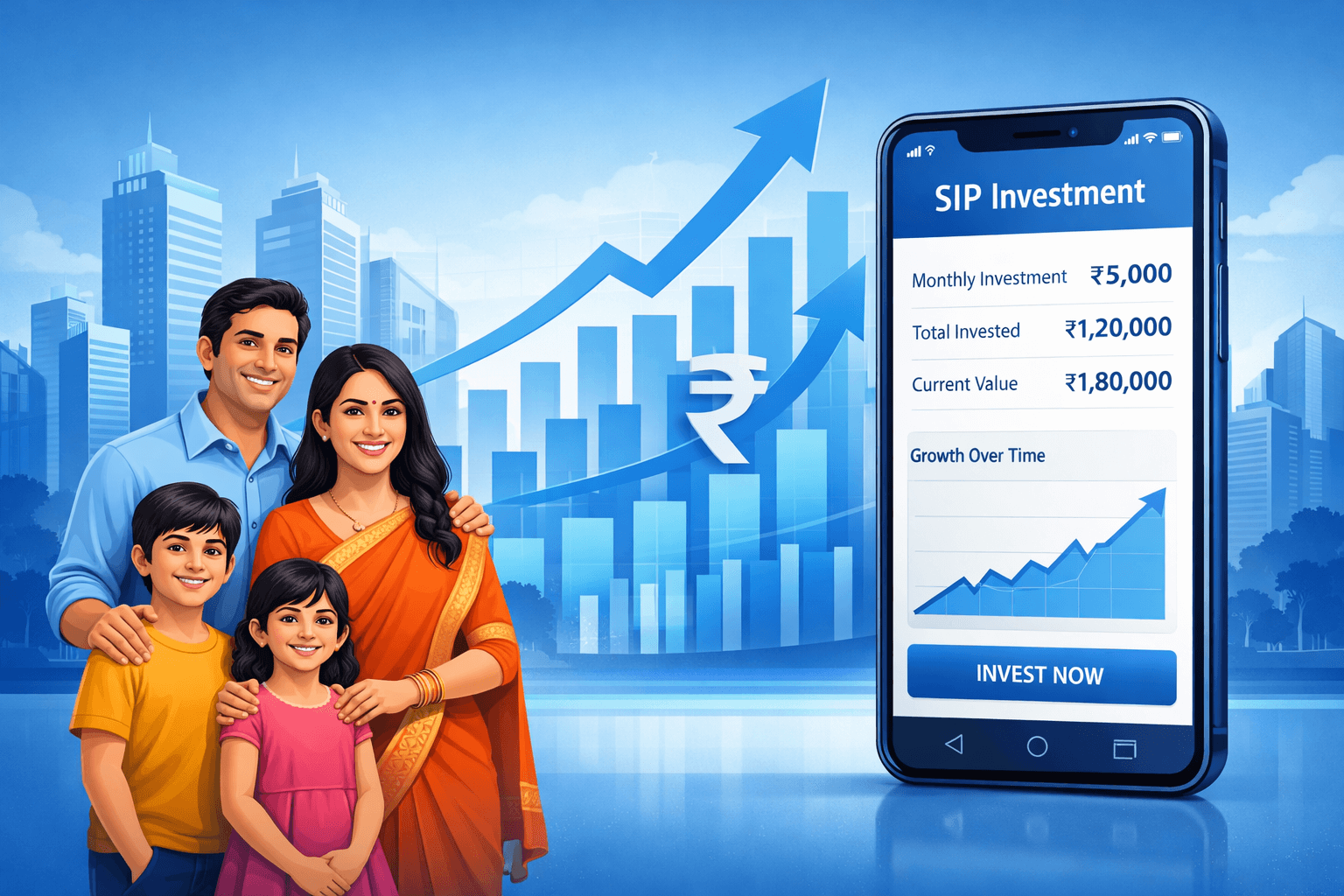

A Systematic Investment Plan (SIP) is one of the smartest and most popular ways to invest in mutual funds in India. Instead of investing a large amount at once, SIP allows you to invest a small, fixed amount at regular intervals — usually monthly.

For many Indians, SIP has become the preferred way to build long-term wealth, save for retirement, and achieve financial goals like buying a house, funding children’s education, or creating a financial safety net.

In this guide, we will explain what SIP is, how it works, its benefits, types, and how you can start SIP in India easily.

What is SIP in Mutual Funds?

SIP stands for Systematic Investment Plan. It is a method of investing where you invest a fixed amount of money at regular intervals into a mutual fund scheme.

For example:

- You choose ₹2,000 per month

- Every month on a fixed date, this amount is automatically invested

- You receive mutual fund units based on that day’s market price (called NAV)

Over time, your investment grows through market returns + compounding, helping you create wealth without stress.

SIP is especially useful for salaried individuals and beginners who want a simple, disciplined, and automated way to invest.

How Does SIP Work? (Simple Explanation)

Here is how SIP works step-by-step:

- You select a mutual fund (Equity, Hybrid, or Debt).

- You choose your SIP amount (₹500, ₹1,000, ₹5,000, etc.).

- You select a monthly date for auto-debit from your bank account.

- The money is automatically invested every month.

- Over time, your investment grows based on market performance.

The best part? You don’t need to worry about market ups and downs — SIP works automatically.

Why SIP is Good for Beginners

SIP is ideal for beginners because:

- You don’t need a large amount of money

- You don’t need to understand complex stock markets

- You don’t need to time the market

- You build a habit of regular saving and investing

Even ₹500 per month can grow into a large amount over 10–20 years due to compounding.

Key Benefits of SIP Investment

1. Rupee Cost Averaging

With SIP, you buy more units when markets are low and fewer units when markets are high. This reduces risk and smoothens your investment journey.

2. Power of Compounding

When your returns are reinvested, your money earns returns on returns. The longer you stay invested, the more powerful compounding becomes.

3. Start with Small Amount

Many mutual funds allow SIP starting from ₹100 or ₹500 per month — making it accessible to everyone.

4. No Need to Time the Market

You invest regularly regardless of market conditions, which removes emotional decision-making.

5. Flexible and Convenient

You can increase, pause, or stop your SIP anytime without major penalties.

Types of SIP in India

There are different types of SIP available:

- Regular SIP – Fixed amount every month

- Top-up SIP – You increase your SIP amount every year

- Flexible SIP – You can change your amount based on income

- Trigger SIP – Investment based on market levels

- Perpetual SIP – No fixed end date

You can choose the type that best suits your financial goals.

| Feature | SIP | Lump Sum |

|---|---|---|

| Investment Style | Monthly installments | One-time |

| Market Risk | Lower | Higher |

| Suitable For | Beginners | Experienced investors |

| Need for Market Timing | No | Yes |

For most retail investors, SIP is safer and easier than lump sum investing.

How to Start SIP in India (Step-by-Step)

You can start SIP using popular apps like:

- Groww

- Zerodha Coin

- Upstox

- ET Money

- Paytm Money

Steps to start SIP:

- Create an account on any investment app

- Complete your KYC

- Choose a mutual fund

- Select SIP amount and date

- Enable auto-debit from your bank

That’s it — your SIP will run automatically every month.

Who Should Invest in SIP?

SIP is best for:

- Salaried employees

- Students

- First-time investors

- People saving for:

- Retirement

- Child education

- Marriage

- House purchase

- Long-term wealth creation

Is SIP Safe?

SIP itself is not guaranteed because mutual funds are market-linked. However, SIP reduces risk over time and is considered one of the safest ways to invest in equity mutual funds for the long term.

Conclusion

SIP is one of the smartest ways to invest in India. It encourages financial discipline, reduces risk, and helps you benefit from long-term market growth.

If you are new to investing, SIP is the perfect starting point.

Start early, invest regularly, and let your money grow — with Credit Khabri as your trusted finance guide.

Check our blog post on Mutual Funds for better understanding