🚨 Financial Scam Alerts 2025: The New Frauds That Can Empty Your Bank Account in Minutes

Introduction: Why Financial Scams Feel More Dangerous Than Ever

If you feel that financial scams have suddenly become more convincing, more personal, and harder to detect you are absolutely right. Financial scam alerts 2025 show a worrying shift: scammers are no longer relying on poor grammar or obvious fake messages. Instead, they are using artificial intelligence, deepfake technology, and psychological manipulation to impersonate banks, employers, and even your own family members.

In late 2024 and throughout 2025, victims across the world have lost money not because they were careless but because the scams looked real. A phone call that sounds exactly like your boss. A video call that looks like a bank officer. A mobile app that mirrors your bank’s interface perfectly. These are no longer rare cases; they are fast becoming the norm.

This guide breaks down the most dangerous financial scam alerts 2025, explains how they work, and gives you practical steps to protect yourself and your loved ones.

The Rise of AI-Powered Fraud: Voice Cloning & Deepfake Video Calls

One of the most alarming trends in financial fraud is the use of AI voice cloning fraud and deepfake video call scams.

Scammers can now:

- Clone a person’s voice using just a few seconds of audio

- Create realistic video calls that mimic real people

- Impersonate CEOs, HR managers, bank officers, or relatives

In many reported cases, employees were tricked into transferring large sums of money after receiving what appeared to be legitimate video calls from senior executives. According to reports tracked by the Federal Trade Commission and the FBI Internet Crime Complaint Center, these scams are rising sharply in both frequency and financial impact.

🔴 Why this works:

People trust faces and voices. AI removes the traditional red flags that once helped us identify fraud.

🔔 Top Financial Scam Alerts 2025: What You Must Watch For

Understanding the patterns behind financial scam alerts 2025 is the strongest defense. Below are the most common and dangerous scams trending right now.

Fake Banking Apps & SMS Phishing

Fake banking apps are among the fastest-growing threats in financial scam alerts 2025. These apps:

- Look identical to real bank apps

- Ask users to “verify” accounts or “update KYC”

- Capture login credentials, OTPs, and UPI PINs

At the same time, SMS phishing messages redirect users to fake websites that closely resemble official bank portals.

⚠️ Common warning signs:

- Messages creating urgency (“account blocked”, “suspicious activity”)

- Links asking for OTP or UPI PIN

- Apps downloaded outside official app stores

Cybersecurity research from Norton highlights that many users cannot visually distinguish fake apps from genuine ones.

“Too Good to Be True” Job & Investment Scams

Job recruitment scams and investment frauds continue to dominate financial scam alerts 2025.

Popular variations include:

- “Task-based” jobs paying for likes or reviews

- Fake crypto or trading platforms promising guaranteed returns

- Advance fee demands for job onboarding or account activation

Once initial payments are made, scammers either vanish or demand increasingly larger amounts.

🚫 Remember:

No legitimate job or investment guarantees fixed or quick profits.

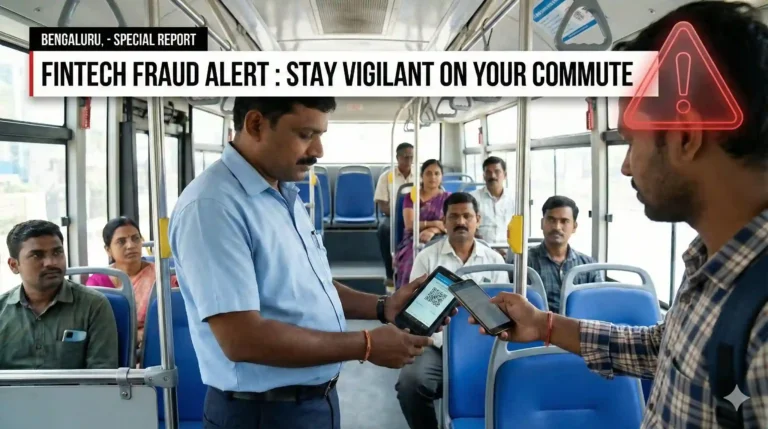

Authorized Push Payment Fraud & UPI Scams

Another major trend in financial scam alerts 2025 is authorized push payment fraud. In these cases, victims are manipulated into voluntarily transferring money.

Scammers pose as:

- Bank fraud departments

- Customer support executives

- Government or tax officials

They guide victims step-by-step to send money via UPI or bank transfer, claiming it is a “temporary hold” or “verification process.”

UPI Fraud Prevention Tips

Pause and verify through official customer care numbers

Never share UPI PIN or OTP

Banks never ask you to “reverse” a transaction

Check out fake loan apps list here

Practical Steps to Protect Your Wallet (Do These Today)

Staying safe in 2026 requires proactive habits. Here’s what actually works:

✅ Strengthen Your Digital Security

- Enable two-factor authentication (2FA) everywhere

- Use strong, unique passwords

- Avoid installing apps from unknown sources

✅ Verify Before You Trust

- Independently confirm calls claiming to be from banks or employers

- Hang up and call official numbers

- Be skeptical of urgency and pressure tactics

✅ Stay Informed

- Follow trusted scam alert sources like the FTC and IC3

- Educate family members, especially seniors and students

Conclusion: Awareness Is Your Strongest Defense

The reality of financial scam alerts 2025 is unsettling—but knowledge is power. Scammers succeed when people feel rushed, isolated, or embarrassed to question authority. By understanding how modern scams work and sharing this information with family and friends, you reduce their chances of becoming victims.

Please share this article with your parents, colleagues, and friends. One conversation today can prevent a financial disaster tomorrow.

🔐 Stay alert. Stay informed. Stay safe.