Improve Credit Score Fast: 10 Powerful & Proven Tips for Quick Results

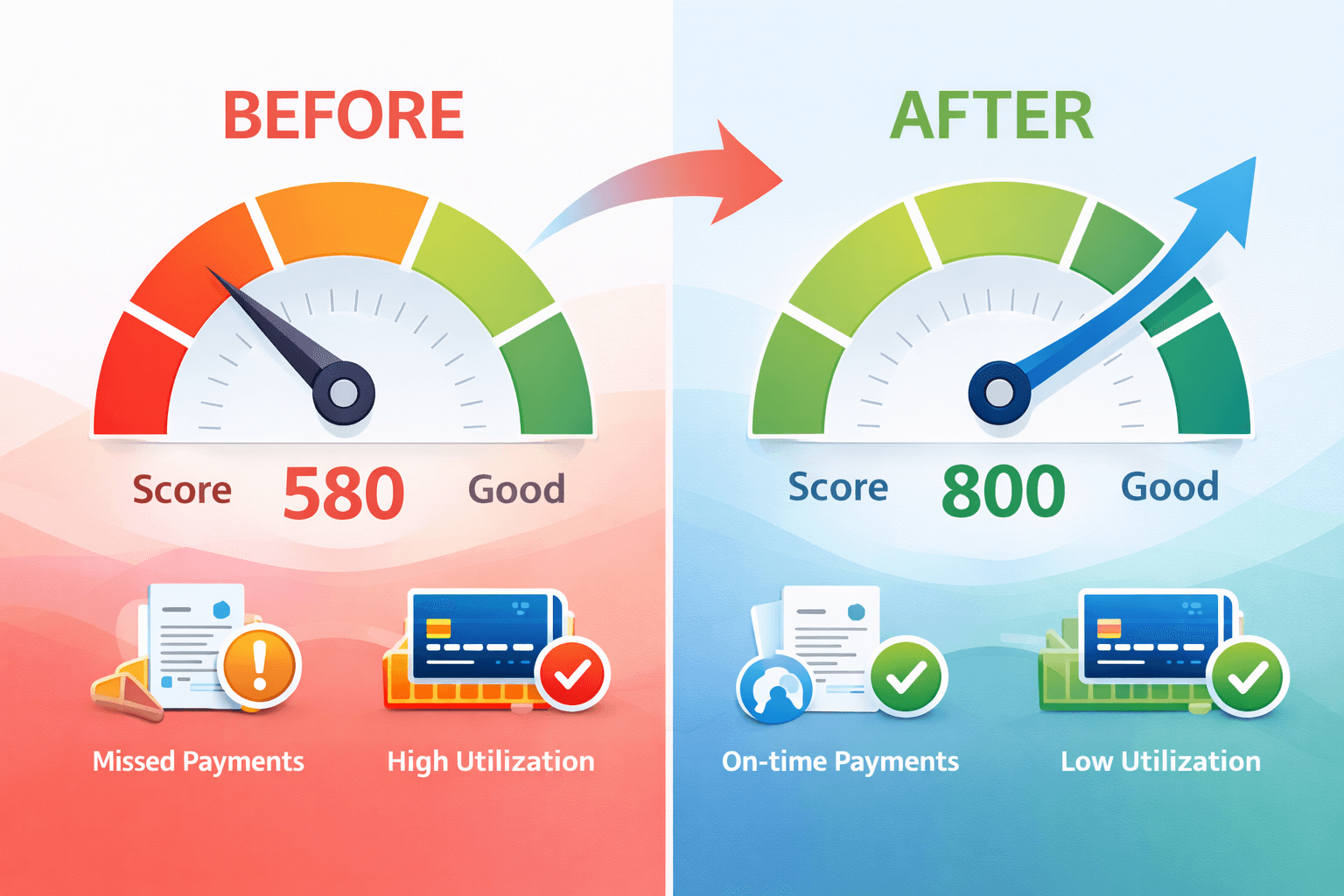

Improve credit score fast is one of the most searched financial goals today — and for good reason. Your credit score decides whether you get a loan, a credit card, lower interest rates, or even rental approvals. A low score can cost you thousands in extra interest, while a high score saves money and opens doors.

The good news? You don’t need years to fix it. With the right strategy, you can improve credit score fast within a few months.

Let’s break it down step-by-step.

What is a Good Credit Score?

In India, scores usually range from 300–900.

- 750+ → Excellent

- 700–749 → Good

- 650–699 → Average

- Below 650 → Needs improvement

You can check your official report at:

👉 CIBIL

👉 EXPERIAN

Pay All Bills on Time (Biggest Impact)

Payment history contributes 35% of your score.

Even one late EMI or credit card payment can hurt badly.

Action:

- Set auto-pay

- Use reminders

- Never miss minimum due

If you want to improve credit score fast, this is non-negotiable.

Reduce Credit Utilization Below 30%

Credit utilization = used limit ÷ total limit

Example:

- Limit ₹1,00,000

- Used ₹80,000 ❌ bad

- Used ₹20,000 ✅ good

High usage signals risk.

Action:

- Pay balances early

- Increase limit

- Split spends across cards

This helps improve credit score fast within 30–60 days.

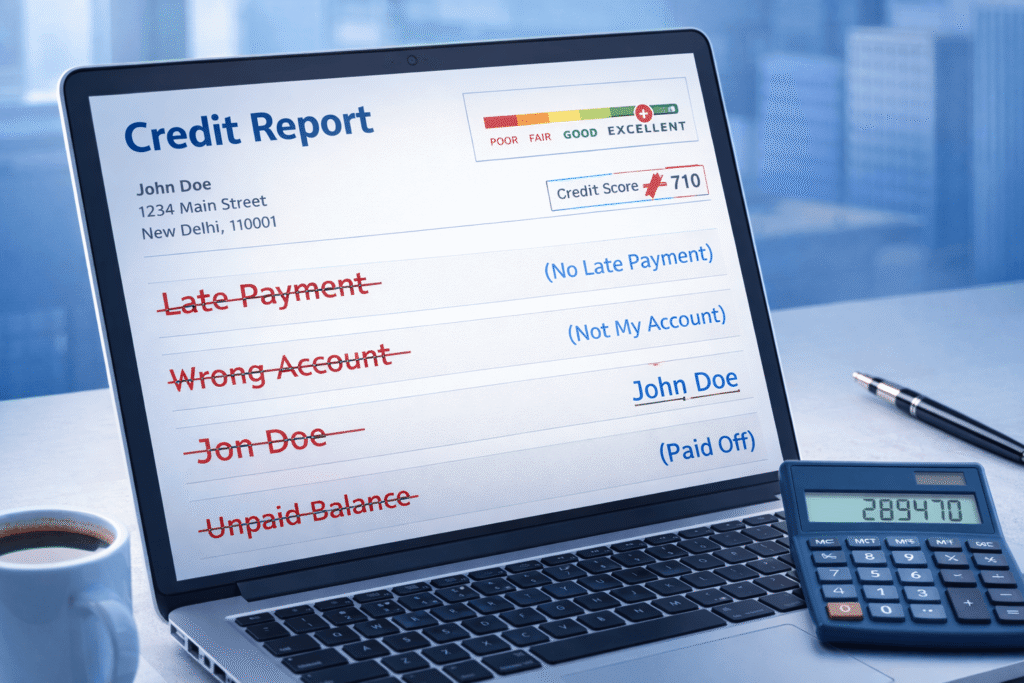

Check Your Credit Report for Errors

Many people lose points because of mistakes.

Common issues:

- Wrong late payments

- Closed accounts showing active

- Duplicate loans

Action:

Download your report and dispute errors immediately.

Don’t Apply for Too Many Loans

Each application creates a hard inquiry, which lowers score.

Multiple inquiries = looks desperate.

Action:

- Apply only when necessary

- Space applications by 3–6 months

Keep Old Credit Cards Active

Longer credit history = better score.

Don’t close your oldest card.

Even small monthly usage helps improve credit score fast gradually.

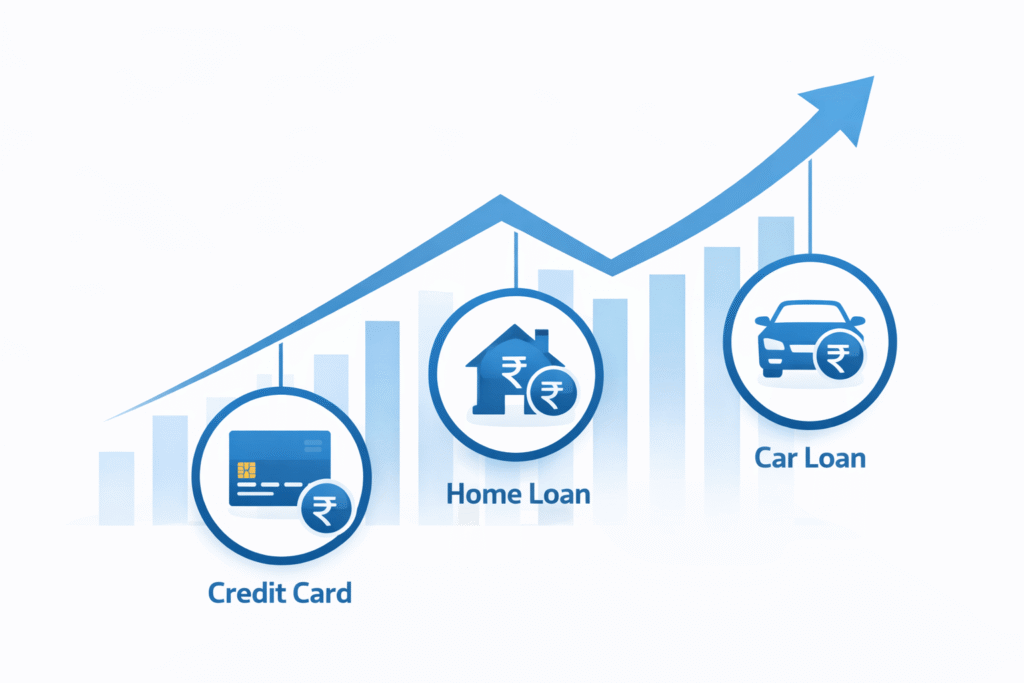

Mix Credit Types Smartly

Having both:

- Credit card

- Personal/auto/home loan

shows responsible borrowing behavior.

Balanced credit mix improves credibility.

Settle Outstanding Dues Immediately

Unpaid or defaulted loans hurt the most.

Negotiate settlements or clear dues ASAP.

Remember:

Closed > Settled > Default

Clearing dues is a quick way to improve credit score fast.

Use EMI & BNPL (Buy Now Pay Later) Carefully

Buy Now Pay Later services also affect credit reports now.

Missed BNPL payments damage your score just like loans.

Use responsibly.

Become an Authorized User

If a family member has a high score, being added to their card can boost yours faster.

Great trick for beginners.

Track Your Progress Monthly

Monitoring motivates improvement.

Free monthly checks help you:

- Spot fraud

- Track growth

- Stay disciplined

Bonus: Build Wealth Alongside Good Credit

While fixing your score, start smart investing too:

👉 Read our SIP Investment Guide

👉 Also check Term Insurance Guide

Financial health = credit + savings + protection.

Final Thoughts

If you consistently follow these steps, you can improve credit score fast within 3–6 months. Small habits create big results.

Start today:

✔ Pay on time

✔ Keep balances low

✔ Monitor report

Your future self (and your bank balance) will thank you.