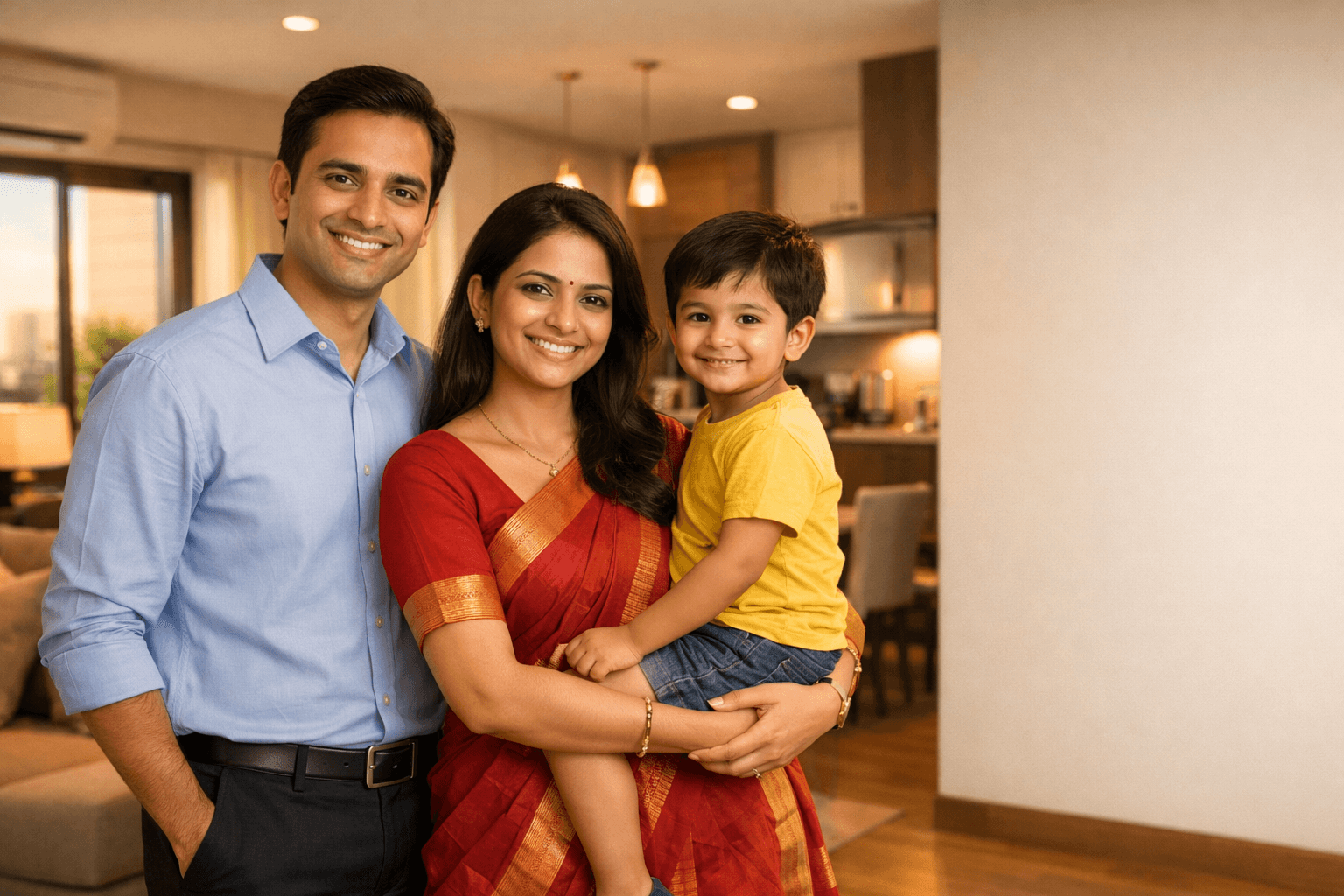

Term Insurance: The Smartest Financial Protection for Your Family

Life is unpredictable, but your family’s financial future doesn’t have to be.

Learning about Term insurance in India is one of the most important — yet most misunderstood — financial products in India today. Despite being affordable and highly beneficial, millions of Indians still remain uninsured or underinsured.

At Credit Khabri, we aim to simplify finance, credit, loans, and insurance for everyday Indians. This is our first dedicated post on Term Insurance, where we break it down in simple language so you can make better financial decisions.

What is Term Insurance?

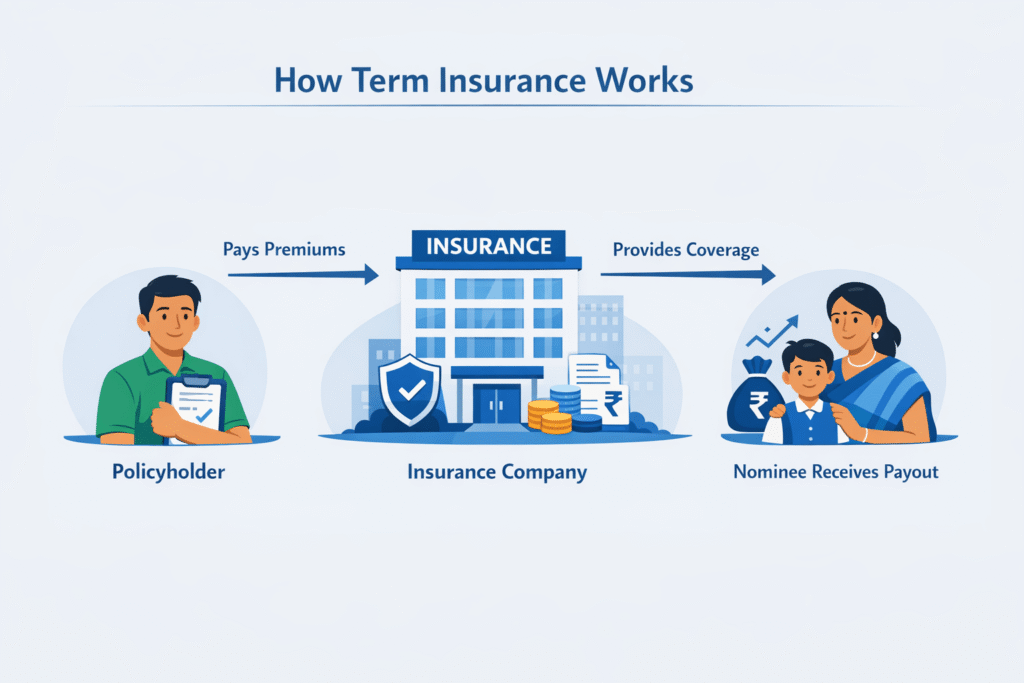

Term insurance is a pure life insurance policy that provides financial protection to your family in case of your unfortunate death during the policy term.

If the policyholder dies within the term — the nominee receives the sum assured.

If the policyholder survives — no payout, but your family was protected throughout the period.

Why is Term Insurance So Affordable?

Unlike traditional life insurance plans (like endowment or money-back policies), term insurance has no investment or savings component, which makes it much cheaper.

| Age | Cover | Annual Premium |

|---|---|---|

| 30 years | ₹1 Crore | ₹8,000 – ₹12,000 |

| 35 years | ₹1 Crore | ₹10,000 – ₹15,000 |

Who Should Buy Term Insurance?

- Working professionals

- Parents

- Single earners

- Business owners

- Home loan borrowers

- Newly married individuals

- People with dependents

If someone depends on your income — you need term insurance.

Want to check our post on life insurance post ? Read our guide on:

Life Insurance

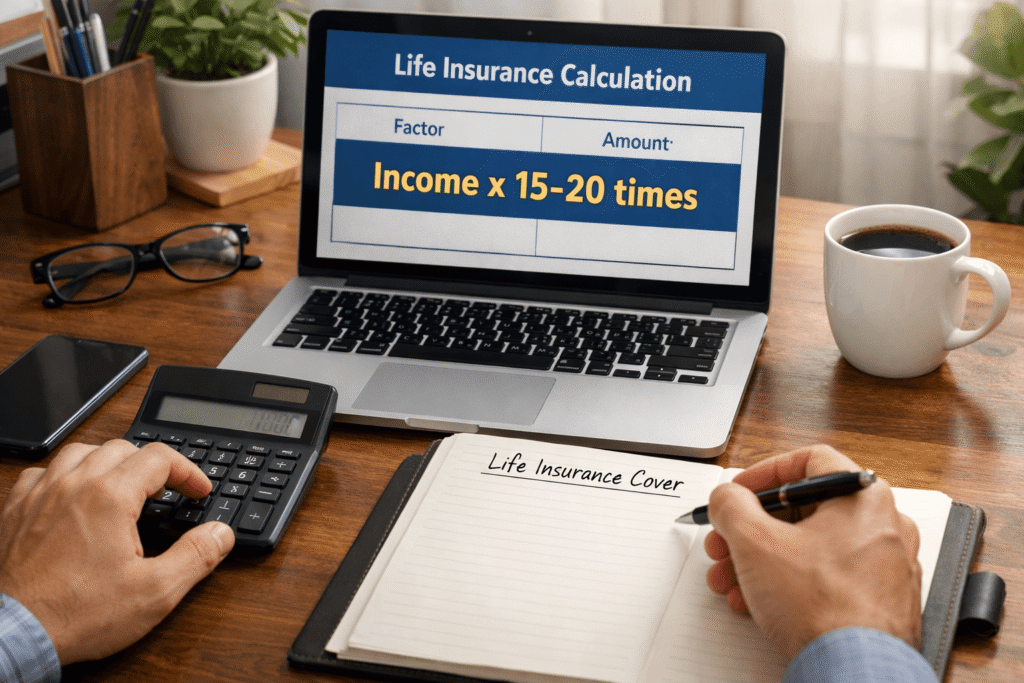

How Much Term Insurance in India, Cover Do You Need?

A simple rule:

👉 Your annual income × 15 to 20 times

Example:

If your income is ₹10 lakh, you should consider ₹1.5 crore to ₹2 crore cover.

Types of Term Insurance Plans in India

- Regular Term Plan

- Increasing Term Plan

- Decreasing Term Plan (good for home loans)

- Return of Premium (TROP)

Benefits of Term Insurance

- Low cost

- High coverage

- Tax benefits under Section 80C

- Peace of mind

- Easy online purchase

Common Myths About Term Insurance

- ❌ “If I don’t die, my money is wasted.”

- ❌ “I’m young, I don’t need it.”

- ❌ “Employer insurance is enough.”

How to Buy Term Insurance Online

- Visit insurer website

- Enter details

- Compare plans

- Choose term

- Upload documents

- Pay premium

Term insurance is not an expense — it is a responsibility.

At Credit Khabri, we will continue educating readers about smart financial decisions. Stay tuned for more posts on insurance, credit, and loans.